#shell petroleum corporation

Explore tagged Tumblr posts

Text

Illustration detail from Shell Petroleum Corporation’s New Orleans and Vicinity Road Map - 1932.

#old new orleans#new orleans#shell oil#road maps#vintage road maps#highway maps#vintage highway maps#shell petroleum corporation#shell petroleum#gas stations#gas station road maps#vintage illustration#vintage advertising#maps#vintage maps#traffic rules#rules of the road#speed limits

13 notes

·

View notes

Text

Good lord. I knew the oil industry was drenched in blood but I didn’t know that literally. Still reading opens veins of Latin America. How the oil barons keep control over Latin America and sometimes literally instigating coups and wars for their own advantage.

One specific example is the Chaco war of 1932-1935. “Huey long shook the United States on may 30,1934 with a violent speech according standard oil of New Jersey of provoking the conflict and of financing the Bolivian army so that it would appropriate the Paraguayan Chaco on its behalf. It needed the Chaco- which was also thought to be rich in petroleum- for a pipeline from Bolivia to the river. “These criminals,” Long charged, “have gone down there and hired their assassins.” At Shell’s urging, the Paraguayans marched to the slaughterhouse: advancing northward, the soldiers discovered standard oil’s perforations at the scene of the dispute. It was a quarrel between two corporations, enemies and at the same time partners within the cartel, but it was not they who shed their blood.” (Page 163)

155 notes

·

View notes

Text

OPINION: STOP THE E-JEEP! #NoToJeepneyPhaseout

Commuter or not, every Filipino is familiar with jeepneys. Once dubbed “King of the Roads”, jeepneys are a symbol of Philippine culture and resourcefulness, as they were made from converted jeeps left by American troops after World War II. As the most popular public transport vehicle in our country for decades, these jeepneys are now at risk of disappearing, causing public uproar.

The controversy surrounding the phasing out of jeepneys first sparked in 2017 when the government launched the Public Utility Vehicle Modernization Program (PUVMP). The program’s goal is to replace the old model jeepneys with modern electronic jeepneys (e-jeeps) that are claimed to guarantee cleaner emissions and improved safety. This has been met with several worries that could adversely affect the Filipino populace.

Public unrest over the jeepney phaseout has been going on for years. The consolidation deadline for Public Utility Vehicles (PUVs) which included jeepneys, UV Expresses, and Filcab units was extended three times. The first was due to the COVID-19 pandemic and multiple protests from transport groups, which affected the government’s original plan to consolidate PUVs in March 2020. As a result, it was rescheduled at the end of last year, December 31, 2023. The second extension was on January 31, 2024, to allow unconsolidated PUVs to ply their routes with the stipulation of being barred from joining cooperatives and corporations. The third and “final” deadline was on April 30, 2024—three months after the last deadline—to allow driver-operators one last time to consolidate, or else they would not be allowed to ply their routes. Amid these several deadlines, protests and strikes are unwavering as dissents push for the PUVMP to be suspended, arguing that imposing deadline extensions does not address the structural problems of the modernization program.

One day before the “final” deadline, the Land Transportation Franchising and Regulatory Board (LTFRB) declared that unconsolidated jeepneys have a 15-day leeway to continue their usual routes before they are impounded. Again, this is another smokescreen from the systemic issues brought by the modernization program. The PUVMP must be suspended, as it ostensibly presents more problems than solutions. If the PUVMP truly is for the people, why is there a persistent and contentious pushback by the public?

Enforcing deadlines and giving grace periods for jeepney drivers only delays—the government must suspend the PUVMP and reevaluate its effectiveness. Displacing and disenfranchising jeepney drivers from their livelihoods defeats the purpose of an inclusive and sustainable program as the PUVMP endorses itself to be.

Who are those affected?

Jeepney drivers are most affected by the modernization program. If they choose not to consolidate with cooperatives and corporations or cannot afford an e-jeep alone, their vehicles will be impounded, taking away their only source of income. Additionally, commuters, UP Diliman constituents, and other sectors also have to bear the cost of the PUVMP due to the policies and funds allocated to this program.

The transport group for jeepney drivers, Pagkakaisa ng mga Samahan ng Tsuper at Opereytor Nationwide, more commonly known as PISTON, is the leading opposition group against the PUVMP. First established in 1981, PISTON serves as an organization that aims to promote the welfare and democratic rights of jeepney drivers. In 2013, they launched a campaign against the oil price hike, directed at the country’s main petroleum companies, namely Petron, Shell, and Chevron. Since the government has revealed plans to phase out jeepneys over 15 years old, they have been organizing protests against the PUVMP, criticizing its anti-poor policies and prioritizing for-profit corporate consolidation.

The PUVMP pressures jeepney drivers to switch to e-jeeps or new combustion engine vehicles that meet Euro IV emission standards which only permit carbon monoxide (CO) emissions of 1.0g/km for gasoline and 0.5g/km for diesel vehicles. Units and parts that make up the e-jeep are imported from other countries, which is why they are priced as high as PHP 3 million. While the modernization program offers subsidies of PHP 160 thousand through loan programs by the Development Bank of the Philippines (DBP) and the Land Bank of the Philippines (LBP) to help offset the costs, this amount is only 5.7% of the total cost of a modern jeepney. Jeepney drivers state that they will need to make around PHP 3.5 thousand each day to pay off the debt from switching to an e-jeep, but at the moment, they only make around PHP 2 thousand a day.

The large amount of money that needs to be spent transitioning to modern e-jeeps is the main concern of dissent to this program. Replacing a huge fleet of jeepneys requires massive resources, taking away from vital sectors such as education and healthcare. Additionally, the PUVMP disproportionately affects low-income citizens—specifically, jeepney drivers who mostly come from low-income families and struggle to meet the high e-jeep cost. The debt burden forces them to work longer hours just to break even, negatively impacting their livelihood. Jeepney drivers worry that the transition to e-jeeps or new combustion engine vehicles will exacerbate their financial burdens and force them to work longer hours just to break even.

Furthermore, units from local manufacturing companies such as eFrancisco Motor Corporation and Sarao Jeepneys are still priced at around PHP 2.5 million, further putting jeepney drivers at odds with the financial burden of the PUVMP. With large corporations dominating the market and the PUVMP’s policy to consolidate driver-operators to cooperative-led fleets, this raises concerns of corporate takeover and the economic marginalization of jeepney drivers. Since large companies are the ones who have the capacity to fully adhere to the program, jeepney drivers are left disenfranchised because of their financial disadvantage.

Commuters are also affected heavily by this program. Modern jeeps usually charge higher fares because, aside from the initial cost of modernization, their maintenance and repair costs are higher than the traditional jeepneys’. This adds more financial problems to Filipinos already facing higher living expenses as a result of inflation rates. Moreover, unfamiliar technology could present a significant challenge for traditional drivers transitioning to modern jeepneys, leading to potential operational difficulties and increased maintenance expenses.

Constituents of UP Diliman (UPD) share similar concerns. The UP Transport Group (UPTG), which consists of jeepney drivers from all routes around the campus such as Ikot, Toki, UP-Pantranco, UP-Philcoa, and UP-Katipunan, organized a silent strike on December 13, 2023, in protest of the earlier December 31 deadline. Based on interviews with the UPD Vice Chancellor for Community Affairs Roehl Jamon, UP jeepney drivers may have to comply with the modernization. According to Jamon, the only two options they have are for the university to pay for the units themselves, which cost about PHP 1.4 to 3 million each, or for the university to partner with transport cooperatives that already own modernized units and invite them to service the campus, which is the less expensive option between the two. Although the latter is cheaper, this still gives way for corporations to take advantage of the modernization program.

Jeepneys are extensively used by UP college students and students of UP Integrated School (UPIS) for commuting to and from the university campus because they charge less than other PUVs. However, these fares could be completely changed by the PUVMP’s effect on jeepney availability and rates, possibly altering their daily commutes by making them spend more on transport alternatives or by forcing them to look for different routes. This might put additional financial burden as well as longer hours of travel in their everyday life, affecting not only their academic performance but also their general welfare.

Moreover, the PUVMP is taking attention and funding from other sectors that have more pressing needs. In particular, the Department of Education (DepEd) is significantly impacted by lack of funding. Classroom and teacher shortages have been notable areas of concern with an estimated 165,444 classrooms and nearly 90,000 teachers needed. According to DepEd, PHP 105 billion would be needed each year up until 2030 to address the classroom shortage, while PHP 5.6 billion would be needed to hire 20,000 teachers in the upcoming school year, as discussed in the Senate plenary deliberations on the proposed 2024 national budget. Aside from the education sector, the Department of Health (DOH) has been grappling with vaccine shortages, namely pertussis, which has led to 54 infant deaths since the beginning of the year. According to the United Nations Children’s Fund (UNICEF), in 2022, the Philippines was among the top 5 contributors to the 18 million zero-dose children in the world. Despite this and multiple warnings from health authorities, the Philippines still hasn’t fully addressed this vaccine gap, leaving one million unvaccinated Filipino children vulnerable and susceptible to life-threatening diseases such as polio, measles, and tuberculosis. In light of these issues, resources should be prioritized in these matters instead of the PUVMP. Action must be taken immediately to address these pressing concerns and ensure the well-being of the Filipino people.

Are E-jeeps really the “better option”?

According to a study by the Center for Energy, Ecology, and Development (CEED), jeepneys only make up about 2% of the total registered vehicles in the nation and PUVs only contribute about 15% of the total particulate matter emissions in Metro Manila. If the PUVMP aims to transform our public transportation into becoming more sustainable and environmentally friendly, this number does not justify the relentless pressure on jeepney drivers to consolidate. The PUVMP will only contribute 2% to the country’s vehicles that cause pollution. This raises the question of the significance of its impact on saving the environment and reducing emissions in the long run. Additionally, modern jeepneys still run on fossil fuels, such as petroleum oil, defeating the purpose of the program’s goal of creating a more environmentally friendly public transport system. In the same study by CEED, it was argued that solely focusing modernization efforts on jeepneys to reduce air pollution would be negligible. Taking this into account, the government should instead consider upgrading traditional jeepneys to meet the proposed emission standards which would be cheaper for the program.

Furthermore, as said in a paper by the UP Center for Integrative and Developmental Studies, drawing from the current rate of assembly of modern jeepneys, it will take an estimated 270 years before all traditional jeepneys in the country are replaced. This begs the question of why the government keeps enforcing deadlines when it will take almost three centuries before all jeepneys are replaced with e-jeeps.

The PUVMP, while well-intentioned, presents a flawed solution. The environmental costs being too high, the unjust burden on the poor, and the uncertain consequences of such a drastic transition are strong arguments for reconsideration. The government should consider other options like rehabilitating existing jeepneys and using cleaner-burning fuels. One example that can be improved with the government’s help is the rehabilitated jeepney proposed by the Libmanan Transport Service Cooperative (LIBTRASCO). This model includes all government-specified features of the modernized jeepney—such as a side door, a higher ceiling, bigger windows, and even stabilizers to account for the increased height. Compared to e-jeeps, these rehabilitated models only cost around PHP 400 thousand to PHP 500 thousand, making them more affordable for jeepney drivers. Though the rehabilitated jeepney still uses the jeepney’s diesel engine, it can still be adapted to use a Euro 4 engine and even include air conditioning. If the government chooses to work with LIBTRASCO and retrofit the rehabilitated jeepney as an alternative, the Philippines can then improve its transport system while keeping its traditional jeepneys and people’s livelihoods by prioritizing affordability, inclusiveness, and a sustainable future.

Modernization shouldn’t be at the expense of the workers. The primary reason why many are aggressively opposing the program is that the welfare of jeepney drivers was not carefully considered when they should be the center of the solution. For the past years that the modernization program has been implemented, instead of listening to the pleas and concerns of jeepney drivers, commuters, and other constituents, the government has kept imposing the jeepney consolidation and resisting any demands by the public.

Taking all of this into account, we must request the government to prioritize policies that consider the money and power of all citizens, especially those from poor backgrounds. This includes subsidizing the move towards modern vehicles or examining other options that do not oppress marginalized communities. Instead of pushing jeepney drivers to consolidate and buy e-jeeps, the government should consider exploring and supporting initiatives that use cleaner-burning fuels and retrofitting existing jeepneys to meet emission standards to help maintain the environment in its sustainable state without overhauling the iconic jeepney fleet.

Above all else, this transition must be led by the workers—jeepney drivers whom the public has relied on for decades. Development must be made with the public in mind, not without.

// by Kela Alcantara & Xia Mentes

References:

Abarca, C. (2024, March 21). Calabarzon, Metro Manila top classroom shortage list – DepEd. INQUIRER.net. https://newsinfo.inquirer.net/1921036/fwd-on-public-classroom-shortage#:~:text=The%20estimated%20total%20number%20of,country’s%20classroom%20shortage%20by%202030

Ansis, JC (December 14, 2015). "Piston: Continuing to fight for the transport sector". CNN Philippines. https://web.archive.org/web/20190131083905/http://cnnphilippines.com/news/2015/12/14/piston-protests-continuing-to-fight-for-transport-sector.html

Bautista, P., Moya, R. (2023, September 3). Jeepney modernization program: Drivers have a steep price to pay. Philstar.com. https://www.philstar.com/headlines/2023/09/03/2293549/jeepney-modernization-program-drivers-have-steep-price-pay

CEED Office. (2018, November). Just Transition in the Philippines. CEED. https://ceedphilippines.com/just-transition-in-the-philippines/

Conde, M. (2019, November 16). Transport coop makes pitch for ‘affordable, safe’ rehabilitated jeepney. RAPPLER. https://www.rappler.com/nation/244909-camarines-sur-transport-cooperative-rehabilitated-jeepney/

Dimalanta, R. Atienza, J. Samonte E. (2023). Putting Transport Workers and Commuters First: The Route to Just Transition in Public Transport Modernization. UP CIDS Policy Brief. ISSN 2619-7286.

Gatarin, G. (2024), Modernising the ‘king of the road’: Pathways for just transitions for the Filipino jeepney. Urban Governance. 4(1). 37-46. https://doi.org/10.1016/j.ugj.2023.11.002

Golez, P. (2024, January 24). Marcos extends jeepney consolidation deadline til April 30. POLITIKO. https://politiko.com.ph/2024/01/24/marcos-extends-jeepney-consolidation-deadline-til-april-30/daily-feed/

Latoza, G. (2023, December 15). What are UP’s plans for commuters amid PUVMP? Tinig ng Plaridel. https://www.tinigngplaridel.net/up-transport-puvmp/

Magramo, K. (2024, January 16). Philippines jeepneys: Will the loud, colorful vehicles soon disappear from the roads?. CNN. https://edition.cnn.com/2024/01/16/asia/philippines-jeepney-phase-out-strikes-intl-hnk/index.html

Mendoza, T. C. (2021, February). Addressing the “blind side” of the government’s jeepney “modernization” program. University of the Philippines Center for Integrative and Developmental Studies. 1-69. ISSN 2619-7456.

Mondoñedo-Ynot, L. (2024, April 10). April 30 is final deadline for Puv Consolidation. SunStar Publishing Inc. https://www.sunstar.com.ph/manila/april-30-is-final-deadline-for-puv-consolidation

Ombay, G. (2023, November 9). DepEd lacks nearly 90,000 teachers - Pia Cayetano. GMA News Online. https://www.gmanetwork.com/news/topstories/nation/887851/deped-lacks-nearly-90-000-teachers-pia-cayetano/story/

Pabustan, D. (2017, September 21). Euro 4, what does it mean and why do we need it?. AutoDeal.https://www.autodeal.com.ph/articles/car-features/euro-4-what-does-it-mean-and-why-do-we-need-it

Philippine Daily Inquirer. (2024, April 14). DOH’s Lack of Vaccine Urgency. INQUIRER.net. https://opinion.inquirer.net/172935/dohs-lack-of-vaccine-urgency

Presidential Communications Office. (2024, January 24). PBBM approves three-month extension of PUV Consolidation. https://pco.gov.ph/news_releases/pbbm-approves-three-month-extension-of-puv-consolidation/

RAC. (n.d.). Euro 1 to Euro 6 guide – find out your vehicle’s emissions standard. https://www.rac.co.uk/drive/advice/emissions/euro-emissions-standards/

Relativo, J. (2023, December 28). Unconsolidated jeepneys, UV Express “allowed to operate” until Jan. 31, 2024. Philstar.com. https://www.philstar.com/headlines/2023/12/28/2321963/unconsolidated-jeepneys-uv-express-allowed-operate-until-jan-31-2024

Relativo, J. (2024, April 30). Unconsolidated jeepneys given “15-day leeway” after consolidation deadline. Philstar.com. https://www.philstar.com/headlines/2024/04/30/2351543/unconsolidated-jeepneys-given-15-day-leeway-after-consolidation-deadline

Reyes, R. O. (2024, January 29). Jeepney drivers rejoice “partial victory” for phaseout extension. SunStar Publishing Inc. https://www.sunstar.com.ph/tacloban/jeepney-drivers-rejoice-partial-victory-for-phaseout-extension#:~:text=approved%20the%20extension%20for%20franchise

Rivas, R. (2023, March 7). In numbers: Why jeepney phaseout is anti-poor, will do little for environment. RAPPLER. https://www.rappler.com/business/numbers-why-government-phaseout-jeepneys-anti-poor-do-little-environment/

Santos, J. (2024, February 7). Consolidation extension is not what the protest demands. Philippine Collegian.https://phkule.org/article/1106/consolidation-extension-is-not-what-the-protest-demands

8 notes

·

View notes

Text

Humans are burning about 40 gigatons (a gigaton is a billion tons) of fossil carbon per year. Scientists have calculated that we can burn about 500 more gigatons of fossil carbon before we push the average global temperature over 2 degrees Celsius higher than it was when the industrial revolution began; this is as high as we can push it, they calculate, before really dangerous effects will follow for most of Earth’s bioregions, meaning also food production for people. Some used to question how dangerous the effects would be. But already more of the sun’s energy stays in the Earth system than leaves it by about 0.7 of a watt per square meter of the Earth’s surface. This means an inexorable rise in average temperatures. And a wet-bulb temperature of 35 will kill humans, even if unclothed and sitting in the shade; the combination of heat and humidity prevents sweating from dissipating heat, and death by hyperthermia soon results. And wet-bulb temperatures of 34 have been recorded since the year 1990, once in Chicago. So the danger seems evident enough.

Thus, 500 gigatons; but meanwhile, the fossil fuels industry has already located at least 3,000 gigatons of fossil carbon in the ground. All these concentrations of carbon are listed as assets by the corporations that have located them, and they are regarded as national resources by the nationstates in which they have been found. Only about a quarter of this carbon is owned by private companies; the rest is in the possession of various nation-states. The notional value of the 2,500 gigatons of carbon that should be left in the ground, calculated by using the current price of oil, is on the order of 1,500 trillion US dollars.

It seems quite possible that these 2,500 gigatons of carbon might eventually come to be regarded as a kind of stranded asset, but in the meantime, some people will be trying to sell and burn the portion of it they own or control, while they still can. Just enough to make a trillion or two, they’ll be saying to themselves—not the crucial portion, not the burn that pushes us over the edge, just one last little taking. People need it.

The nineteen largest organizations doing this will be, in order of size from biggest to smallest: Saudi Aramco, Chevron, Gazprom, ExxonMobil, National Iranian Oil Company, BP, Royal Dutch Shell, Pemex, Petróleos de Venezuela, PetroChina, Peabody Energy, ConocoPhillips, Abu Dhabi National Oil Company, Kuwait Petroleum Corporation, Iraq National Oil Company, Total SA, Sonatrach, BHP Billiton, and Petrobras.

Executive decisions for these organizations’ actions will be made by about five hundred people. They will be good people. Patriotic politicians, concerned for the fate of their beloved nation’s citizens; conscientious hard-working corporate executives, fulfilling their obligations to their board and their shareholders. Men, for the most part; family men for the most part: well-educated, well-meaning. Pillars of the community. Givers to charity. When they go to the concert hall of an evening, their hearts will stir at the somber majesty of Brahms’s Fourth Symphony. They will want the best for their children.

Kim Stanley Robinson, The Ministry for the Future

2 notes

·

View notes

Text

Shell is by far the largest foreign stakeholder in the Nigerian economy, owning 47 percent of the oil industry. Its joint venture partner in the petroleum business during Nigeria's most draconian years was the Abacha regime. Yet Shell representatives have repeatedly declared that they exercise no influence over Nigeria's rulers; Europe's largest oil corporation has thereby ducked behind the brutalities of its militaristic financial partners. Such an arrangement means that Shell and other foreign oil corporations can maintain their desired technological presence while, under cover of deference for national sovereignty, they continue to act as ethical absentees.

This arrangement has also enabled Shell to ignore appeals by the Ogoni, the Ijaw, the Ikwerre and other neighboring micro-minorities for a share of oil revenues, a measure of environmental self-determination, and economic redress for their devastated environment. For Shell, Chevron, and the other oil majors operating in the delta, these are internal, Nigerian matters that belong to a sovereign realm inaccessible to corporate influence. But the record suggests otherwise: Chevron, for example, has acknowledged transporting Nigerian forces to quell uprisings in the oil camps of Rivers State. Shell has imported arms for the Nigerian police, paid retainers to Nigerian military personnel, and made boats and helicopters available to them in assaults against protestors. This is all integral to what one former Shell scientist has dubbed "the militarization of commerce" - an apt designation, if ever there was one, of resource extraction procedures under neoliberalism across the global South.

slow violence and the environmentalism of the poor, rob nixon

#climate change#currently reading#the militarisation of commerce is a really useful phrase for something i hadnt had a specific name for before!!#quotes#ecology#environmental science

4 notes

·

View notes

Text

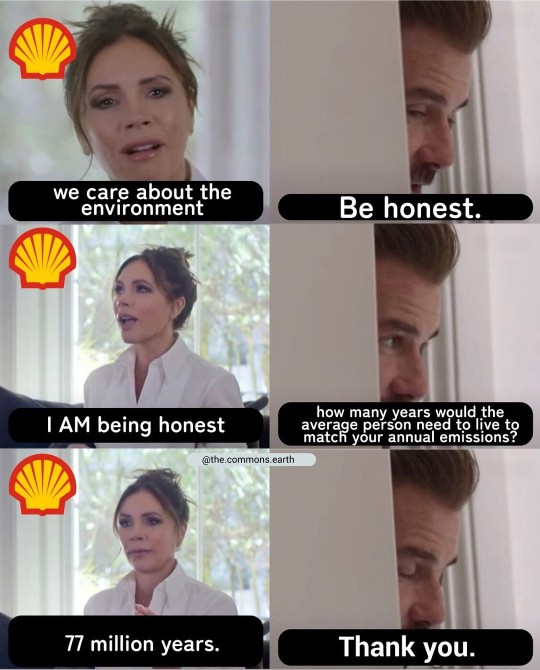

Okay, I have kind of a nagging comment about the first one about Shell.

Shell is a big, multinational company, and it exists only because there are so many people who want to buy petroleum — particularly gasoline. If the demand for gas went away, Shell would do the same. It makes more sense, then, to consider how much Shell (and other gas companies) increase the share of emissions per average customer than it does to talk about the aggregate — the bigger a given gas company gets, the more emissions it will have, and they’re mostly so huge that the numbers are naturally going to be gigantic.

Now, this is actually a very messy calculation to make without doing a lot more research work than I am willing to put in, so please understand up-front that although I’ve looked up some numbers, all of which turned out to be from Statista.com, there are a lot of assumptions being made here which might be false. Without thinking too hard about it for more subtle potential nitpicks, I’m assuming that:

the number of people who buy gasoline in the US is approximately the number of vehicles in the US (that is, there may be households with multiple cars, but households with multiple cars generally have one gas-buyer per vehicle; the number of individuals who personally own multiple vehicles is small) — or, in other words, the number of gas buyers is approximately the number of vehicles

it is reasonable to equate market share of gas sales in the US directly to percentage of gas buyers in the US

the amount of profit per gas buyer in the US is equivalent to the amount of profit per gas buyer in the rest of the world

the “77 million years” figure is based on the global average, not the US average, since Shell is a multinational company

the “77 million years” figure is not already calculated into the average customer’s carbon emissions as quoted (I’ve always kind of wondered about that — the carbon footprint calculators I’ve seen always ask about your gas and manufactured goods consumption, which would mean that those carbon footprint quotations assume corporate emissions are effectively 0 because business emissions are all rolled into the figures for their customers. But we’ll assume here that this is not the case.)

In the last decade Shell actually usually made more profit in both Asia and Europe, separately, than in the Americas. (The overwhelming majority of its profit in the Americas is from the US, but even adding in the rest they still usually get more from Asia and Europe — and even in years where the Americas aren’t in third place, they still don’t go far above a third of the total). Let’s simplify and say that the Americas make up a third of their profits and the US is 30%. (These are both overestimates, meaning they will tend to reduce the estimated number of customers.)

Shell had, in 2019, a 12.5% share of gas sales in the US. (No need to round or anything, that’s directly the number Statista.com said.)

In 2019, there were over 276 million registered vehicles in the US; we’ll round down to 250 million to account for public vehicles — there are buses in the US — and those people who personally own multiple vehicles.

So, out of an estimated 250 million gasoline buyers in the US in 2019, Shell had a 12.5% share, which is 31.25 million; call it 30 million. We are explicitly assuming that Shell makes the same profit per customer everywhere in the world and the US generally makes up 30% of its profits, so each percentage of its profit is 1 million people, and therefore worldwide it has 100 million customers. (I swear I didn’t pick any of the rounded values with this in mind in advance — the numbers just worked out that way.) (I suspect that this number is far too low, but it’s a loose estimate to demonstrate my point so that isn’t really all that important.)

Now, if Shell is generating enough emissions that an average person would have to live 77 million years, but it has 100 million customers, then from another perspective it is raising the emissions of its customers by slightly over ¾ — if the average person is personally responsible for annual carbon emissions of 4 tons (the global average; much higher for developed nations), then by being a Shell customer, they cause an additional 3 tons of emissions for which they are not considered personally responsible. That’s pretty terrible, but I’m not 100% convinced that it is possible to have fossil fuel usage without figures that are just as appalling — in which case the problem isn’t that Shell is specifically Shell, it’s that gas companies exist at all. It would be interesting to patch up the estimated value above to correct for the assumptions and get more accurate values, and then to do the calculations for other gas companies and see whether Shell really is more egregious than the others; if that were the case, it would immediately justify worldwide consumer boycotts — you could immediately lower your carbon footprint, without even cutting your gas consumption, by simply not using Shell gas.

(If the average emissions figure per person includes all the emissions from consumerism, as I mentioned that carbon footprint calculators tend to do, then it means — with this estimate, at least — that ¾ of the average Shell customer’s annual emissions are purely from their gas purchases from Shell, and that’s even more appalling!)

feel free to share the truth...

22K notes

·

View notes

Text

Railway Lubricants Market Size, Analyzing Trends and Projected Outlook for 2025-2032

Fortune Business Insights released the Global Railway Lubricants Market Trends Study, a comprehensive analysis of the market that spans more than 150+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

The Railway Lubricants Market is experiencing robust growth driven by the expanding globally. The Railway Lubricants Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Railway Lubricants Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. Railway Lubricants Market Size, Share & Industry Analysis, By Type (Wayside Lubrication System, On-Board Lubrication System, Spray System, Other), By Product Type (Lithium Grease, Calcium Grease, Other Grease), By Application Type (Bearings and Wheels, Rail Curves, Rail Switch Plates And Turnouts, Others) And Regional Forecast 2021-2028

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/105489

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Major Railway Lubricants Market Manufacturers covered in the market report include:

Major players operating in the global railway lubricants market include Royal Dutch Shell PLC, The Timken Company, Momar, Inc., Petroliam Nasional Berhad (PETRONAS), CITGO Petroleum Corporation, China Petroleum & Chemical Corporation, Exxon Mobil Corporation, Klüber Lubrication, FUCHS LUBRITECH GmbH, and L.B. Foster Company among others.

The subway networks in many countries such as India, Kuwait, and Dubai are growing at a healthy rate, which has created a significant demand for railway lubricants. In addition, the railway sector globally is also investing heavily in the development of high-speed train networks. For example, China and Japan have invested millions of dollars for developing high-speed railway networks, which in turn is projected to provide new business opportunities for the investors in the global railway lubricant market

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

North America (United States, Mexico & Canada)

South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Railway Lubricants Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Railway Lubricants Market?

► Who are the prominent players in the Global Railway Lubricants Market?

► What is the consumer perspective in the Global Railway Lubricants Market?

► What are the key demand-side and supply-side trends in the Global Railway Lubricants Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Railway Lubricants Market?

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

Political (Political policy and stability as well as trade, fiscal, and taxation policies)

Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

Technological (Changes in digital or mobile technology, automation, research, and development)

Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Points Covered in Table of Content of Global Railway Lubricants Market:

Chapter 01 - Railway Lubricants Market for Automotive Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Railway Lubricants Market - Pricing Analysis

Chapter 05 - Global Railway Lubricants Market Background or History

Chapter 06 - Global Railway Lubricants Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Railway Lubricants Market.

Chapter 08 - Global Railway Lubricants Market Structure & worth Analysis

Chapter 09 - Global Railway Lubricants Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Railway Lubricants Market Research Methodology

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

0 notes

Text

Global Chemical Market Size, Share, and Industry Outlook

Global Chemical Market to Reach USD 4.95 Trillion in 2031, Driven by Sustainability, Digitalization, and Specialty Chemicals Growth.

The Global Chemical Marketwas valued at USD 3.08 trillion in 2023 and is projected to reach USD 4.95 trillion by 2031, growing at a compound annual growth rate (CAGR) of 6.1% during the forecast period from 2024 to 2031.

The Global Chemical Market is a cornerstone of industrial progress, playing a critical role in diverse sectors including agriculture, pharmaceuticals, construction, automotive, and consumer goods. Valued at over USD 4.5 trillion, the market continues to evolve, driven by innovations in specialty chemicals, sustainability mandates, and the transition toward green and bio-based alternatives. Rapid industrialization in emerging economies and strong demand for performance materials and consumer-centric chemicals are also fueling the market's expansion.

Key Players

Key Players in Pharmaceutical Chemicals: The major key players are BASF, Lonza, Porton Fine Chemicals, Dishman, Abbott, Johnson Matthey, Lanxess, Jubilant Life Sciences, Vertellus Holdings, and Hikal.

Key Players in Agrochemicals: The major key players are Bayer AG, The DOW Chemical Company, ADAMA Ltd., BASF SE, Nufarm, Clariant AG, Solvay, Evonik Industries AG, FMC Corp., and UPL.

Key Players in Specialty Chemicals: The major key players are Clariant AG, Croda International Plc, Solvay, DuPont, Akzo Nobel N.V., Huntsman International LL, Lanxess, Evonik Industries AG, Arkema, and The Lubrizol Corporation.

Key Players in Personal Care and Cosmetics: The major key players are Procter & Gamble, Unilever, Shiseido, The Estée Lauder Companies Inc., MacAndrews & Forbes (Revlon), L’Oréal S.A., Avon Products Inc., Kao Corporation, Oriflame Cosmetics S.A., and Coty Inc.

Key Players in Industrial Gases: The major key players are Air Products Inc., Air Liquide, Taiyo Nippon Sanso Corp., Linde plc., Matheson Tri-Gas Inc., INOX-Air Products Inc., SOL Group, Messer, BASF, and Iwatani Corp.

Key Players in Polymers: The major key players are Eastman Chemical Company, Evonik Industries AG, Royal DSM, Dow Inc., BASF SE, Mitsui Chemicals Inc., Exxon Mobil Corporation, Clariant International Limited, Huntsman Corporation, and Covestro AG.

Key Players in Petrochemicals: The major key players are Reliance Industries Ltd., Chevron Corporation, LG Chem., LyondellBasell Industries Holdings B.V., Royal Dutch Shell PLC., China National Petroleum Corporation, Dow, SABIC, INEOS Group Ltd., and Mitsubishi Chemical Corporation.

Future Scope & Emerging Trends

The global chemical industry is embracing a shift toward sustainable and circular production models, focusing on green chemistry, bio-based feedstocks, and low-carbon manufacturing. Digitalization, including AI-driven process optimization and data analytics, is enhancing operational efficiency. Specialty chemicals, advanced polymers, and battery materials are witnessing strong demand in sectors like electric vehicles, electronics, and renewable energy. Moreover, Asia-Pacific remains a high-growth region, propelled by industrial investments and a growing middle class. With increasing regulatory pressures, companies are also investing in compliance technologies and safer chemical alternatives.

Key Points

Market expected to exceed USD 4.95 trillion by 2031, with a steady CAGR.

Growth fueled by demand in automotive, construction, agriculture, and healthcare sectors.

Shift toward green chemistry and bio-based chemicals is accelerating.

Digital transformation and automation are reshaping production processes.

Asia-Pacific dominates, led by China, India, and Southeast Asian nations.

M&A activity continues to consolidate specialty chemical segments.

Conclusion

The Global Chemical Market stands at the nexus of innovation, environmental responsibility, and industrial necessity. As industries transform to meet sustainability goals, the chemical sector will remain integral, offering solutions that support cleaner technologies, advanced materials, and global development. Stakeholders that prioritize innovation and eco-efficiency are well-positioned for long-term success.

Related Reports:

Thermoplastic Polyurethane (TPU) Market Size, Share & Segmentation By Type (Polyester, Polyether, Polycaprolactone and Others), By Application, By Region and Global Forecast 2024-2032

Graphene Market Size, Share & Segmentation By Product (Graphene Nanoplatelets, Graphene Oxide, Reduced Graphene Oxide, Monolayer Graphene, Bulk Graphene, and Others), By Application (Paints & Coatings, Electronic Components, Composites, Batteries, Solar Panels, and Others), By End-Use (Automotive, Medical, Aerospace, Defense, Concrete Industry, Tires, and Others) By Region and Global Forecast for 2024-2032

Fluorosurfactant Market Size, Share & Segmentation by Type (Anionic, Non-ionic, Amphoteric, Cationic), by Application (Paints & Coatings, Adhesives, Detergents & Cleaning Agents, Flame Retardants, Oil & Gas, Others), by Regions and Global Forecast 2024-2032

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Global Chemical Market#Global Chemical Market Size#Global Chemical Market Share#Global Chemical Market Report#Global Chemical Market Forecast

0 notes

Text

Illustration detail from Shell Petroleum Corporation’s New Orleans and Vicinity Road Map - 1932.

#old new orleans#new orleans#shell oil#road maps#vintage road maps#highway maps#vintage highway maps#shell petroleum corporation#shell petroleum#gas stations#gas station road maps#vintage illustration#vintage advertising#maps#vintage maps#bonnet carre spillway#flood control#flooding#floods

4 notes

·

View notes

Text

Miguel Zaragoza Fuentes and the Zeta Gas Foundation: A Vision of the Future

Discover how Miguel Zaragoza Fuentes founded Zeta Gas in the 1960s and turned it into a global leader in LP gas distribution, with innovation, expansion, and sustainability.

The beginning of a business vision

In the 1960s, Mexico was experiencing accelerated industrial growth, generating a growing demand for reliable energy for homes and businesses. Miguel Zaragoza Fuentes , a visionary entrepreneur with a strong sense of purpose, identified a key opportunity in the distribution of liquefied petroleum gas (LPG), a fuel that offered efficiency and affordability compared to other energy sources at the time.

In a context where gas supply infrastructure was limited and inefficient, Zaragoza Fuentes envisioned a business model that could transform the industry and improve the lives of millions of people.

With that clarity of vision, he founded Zeta Gas , a company that not only sought to meet market demand but also to innovate in LPG distribution and storage logistics. His focus was on operational efficiency, safety, and international expansion, elements that would soon consolidate Zeta Gas as a leader in the sector.

The consolidation of Zeta Gas in the Mexican market

From its early years, the Zeta Gas Group stood out for its ability to adapt and grow. Miguel Zaragoza Fuentes implemented innovative strategies that optimized the distribution of LP gas, allowing it to reach a greater number of consumers efficiently and safely.

To achieve this, it invested in storage technology, modernized its transportation fleet, and trained its staff, ensuring superior service quality.

One of the pillars of Zeta Gas 's growth was its distribution network, which gradually expanded throughout Mexico. Thus, the company was able to establish a solid infrastructure with strategically located storage plants and distribution centers that guarantee a constant supply. The trust it generated among consumers was key to its rapid market acceptance, consolidating its position as one of the most important energy companies in the country.

International expansion: From Mexico to the world

The success achieved in Mexico wasn't enough for Miguel Zaragoza Fuentes , who always had his eye on new expansion opportunities. Aware of the growing demand for LP gas in other countries, he began an internationalization process that led Zeta Gas to consolidate its position in key markets such as Central America, the Caribbean, Peru, Spain, and the United States.

To achieve this expansion, the company replicated its business model based on efficiency, safety, and customer proximity. Zeta Gas established strategic alliances with large corporations such as Shell , which allowed it to strengthen its presence in the region and improve its logistics capabilities.

In addition, it developed storage plants and distribution terminals that guaranteed a stable supply of LPG in new markets. Zeta Gas 's impact in these countries was significant, contributing to local economic development and creating thousands of jobs. In many regions, the company's arrival meant an improvement in the quality of life for the population by facilitating access to a reliable and affordable energy source.

Innovation and commitment to sustainability

Miguel Zaragoza Fuentes 's core values has been his commitment to innovation and sustainability. Aware of the importance of reducing the environmental impact of the energy industry, Zeta Gas has implemented various initiatives to optimize the use of LPG and minimize its carbon footprint.

the modernization of its transportation fleet with low-emission vehicles. Also notable is the incorporation of technologies that reduce gas leaks at its storage plants and the promotion of green programs such as "Zeta Gas, the Ecological Flame" in Guatemala, which encourages the efficient use of gas to reduce deforestation.

Miguel Zaragoza Fuentes ' vision of a responsible business that not only seeks profitability but also the well-being of the environment and society.

A legacy of leadership and growth

The career of Miguel Zaragoza Fuentes and the founding of Zeta Gas represent a success story in the energy sector. His entrepreneurial vision, ability to adapt to market challenges, and commitment to quality have been key to making Zeta Gas a global leader in LPG distribution.

Today, Zeta Gas continues to grow and evolve, consolidating itself as a company that not only provides energy but also drives economic and social development in the regions where it operates. The story of its founding is a testament to Zeta Gas 's global impact , a symbol of the positive impact a company can have when a clear vision is combined with determination, innovation, and commitment to the community.

Conclusion

The story of Zeta Gas is an example of how a visionary idea can transform into a giant in the energy industry. Miguel Zaragoza Fuentes not only recognized a market need, but also built a solid company that has expanded internationally, ensuring access to reliable energy in multiple countries.His leadership has enabled Zeta Gas to continue innovating and pursuing sustainability, demonstrating that business growth can go hand in hand with social and environmental responsibility.

#Digitalization#MiguelZaragozaFuentes#ZetaGas#TechnologicalInnovation#DigitalTransformation#FutureEnergy#TechnologicalLeadership

0 notes

Text

Lubricants Market Set to Reach $259.1 Billion by 2035, Driven by Automotive and Industrial Advancements

The global lubricants market is expected to grow significantly, reaching $259.1 billion by 2035, up from $145.3 billion in 2024, with a CAGR of 5.4% during the forecast period. This growth is primarily driven by the automotive sector, industrial advancements, and technological improvements in lubricant formulations.

https://datastringconsulting.com/industry-analysis/lubricants-market-research-report

Key Applications and Growth Drivers

Lubricants are essential in various industries, and their applications span a wide range of sectors:

Automotive Lubricants: Vital for engine efficiency and longevity.

Industrial Lubricants: Used in manufacturing and heavy machinery to reduce friction and wear.

Marine Lubricants: Ensures smooth operation of ships and marine engines.

Aerospace Lubricants: Critical for high-performance engines and systems in aircraft.

The market report identifies opportunities for growth based on product types, end-use industries, base oil types, and sales channels, providing a comprehensive revenue forecast for each segment.

Competitive Landscape and Market Leadership

The lubricants market is highly competitive, with key players actively expanding their portfolios and technologies:

Royal Dutch Shell

ExxonMobil Corporation

British Petroleum (BP)

Total SA

Chevron Corporation

FUCHS

Lukoil

PetroChina Company Limited

Idemitsu Kosan

Sinopec Limited

Valvoline

Castrol

These companies are focusing on sustainability, innovative formulations, and expanding their product lines to cater to growing demand in both traditional and emerging markets.

Emerging Opportunities and Trends

The lubricants market is positioned for substantial growth driven by several key opportunities:

Expansion of Synthetic Lubricants: Increased demand for high-performance synthetic lubricants in automotive and industrial applications.

Strategic Alliances: Collaborations with automobile manufacturers to develop custom lubricants for specific vehicle types.

Prospecting in Developing Countries: Expanding market reach in developing regions, including Vietnam, Philippines, and Chile, where industrialization and automotive markets are rapidly growing.

These opportunities are expected to fuel growth in established and emerging markets such as the U.S., China, Germany, India, and Russia.

Regional Insights and Supply Chain Evolution

North America and Asia-Pacific are the leading regions in the lubricants market, driven by robust automotive sectors and industrial activities. However, challenges such as regulatory compliance and technological disruptions are impacting supply chains.

The lubricants market’s supply chain is evolving, with advancements in raw material procurement, production technologies, distribution networks, and warehousing capabilities. As manufacturers seek to diversify revenue streams, there is an increased focus on emerging markets such as Vietnam, Philippines, and Chile, which are witnessing increased demand for lubricants across various sectors.

About DataString Consulting

DataString Consulting is a premier market research and business intelligence firm offering customized solutions for both B2C and B2B industries. With over 30 years of combined experience, DataString Consulting provides actionable insights that help businesses solve challenges, capitalize on growth opportunities, and drive competitive advantage.

Services offered include:

Tailored market research

Strategic consulting

Opportunity assessment

Competitive intelligence

Our team of experts delivers comprehensive research reports designed to meet the strategic objectives of businesses across more than 15 industries, ensuring that clients receive precise, relevant, and timely information.

0 notes

Text

Top 20 EPC Contractors in 2024: Leading the Future of Engineering Excellence

The Engineering, Procurement, and Construction (EPC) industry is the backbone of global infrastructure development, driving progress across various sectors such as oil & gas, energy, and construction. In 2024, we’ve witnessed significant advancements and the emergence of industry leaders who are shaping the future. This article ranks the top 20 EPC contractors of 2024, showcasing their expertise, notable projects, and why they stand out.

Ranking Criteria

To determine the top EPC contractors of 2024, we considered the following factors:

Project Portfolio: The scale, complexity, and success of completed projects.

Innovation: Adoption of cutting-edge technologies and sustainable practices.

Global Reach: Presence in international markets and cross-border capabilities.

Client Satisfaction: Track record of delivering on time and within budget.

Financial Stability: Revenue growth and profitability.

Industry Recognition: Awards, certifications, and recognition within the industry.

1. Mike n Dad (mikendad.com)

Headquarters: UAE Notable Projects: The Jebel Ali Oil Terminal, ADNOC Refinery Expansion Overview: Mike n Dad stands at the pinnacle of the EPC industry in 2024, thanks to its unparalleled expertise in delivering large-scale projects with precision and innovation. As an industry leader, the company has successfully executed complex projects across the oil & gas, energy, and infrastructure sectors. Mike n Dad’s commitment to quality, customer-centric approach, and integration of advanced technologies have set new benchmarks in the EPC domain, earning them the top spot on this list.

2. Bechtel

Headquarters: USA Notable Projects: Jubail Industrial City, Crossrail Project, UK Overview: Bechtel is a global powerhouse in the EPC sector, renowned for its ability to manage some of the world’s most challenging projects. Their focus on sustainability and innovation, along with a diverse portfolio, ensures their continued relevance and dominance in the industry.

3. Technip Energies

Headquarters: France Notable Projects: Yamal LNG, Shell Prelude FLNG Overview: Technip Energies excels in energy transition projects, leveraging its expertise in natural gas, renewable energies, and petrochemicals. The company’s focus on sustainable development positions it as a leader in the evolving energy landscape.

4. Fluor Corporation

Headquarters: USA Notable Projects: Al-Zour Refinery, Qatar Petroleum’s North Field Expansion Overview: Fluor Corporation’s impressive portfolio spans across energy, chemicals, and infrastructure. Their client-centric approach and commitment to safety and sustainability continue to drive their success in the global EPC market.

5. Saipem

Headquarters: Italy Notable Projects: Zohr Gas Field Development, Tangguh LNG Expansion Overview: Saipem’s expertise in offshore projects and energy infrastructure makes it a key player in the EPC industry. Their innovative approach to project execution ensures that they remain at the forefront of the industry.

6. Petrofac

Headquarters: UK/UAE Notable Projects: Upper Zakum Field Development, Khazzan Gas Field Overview: Petrofac’s strong presence in the Middle East and its specialization in complex oil & gas projects have earned them a solid reputation as a reliable EPC contractor.

7. McDermott International

Headquarters: USA Notable Projects: Cameron LNG, BP Tortue/Ahmeyim Overview: McDermott is known for its engineering excellence and ability to deliver large-scale projects in the oil & gas sector. Their focus on innovation and sustainability drives their ongoing success.

8. Hyundai Engineering & Construction

Headquarters: South Korea Notable Projects: Ruwais Refinery Expansion, S-Oil’s RUC Project Overview: Hyundai E&C’s experience in mega-projects, particularly in the Middle East, and their innovative approach to EPC services make them a formidable player in the industry.

9. JGC Corporation

Headquarters: Japan Notable Projects: Ichthys LNG Project, Petronas LNG Train 9 Overview: JGC Corporation’s global presence and expertise in energy and petrochemical projects position them as a leader in the EPC sector, particularly in Asia and the Middle East.

10. KBR, Inc.

Headquarters: USA Notable Projects: Gorgon LNG, Pluto LNG Overview: KBR’s long-standing expertise in the energy sector, combined with their commitment to innovation and sustainability, makes them a key player in the EPC industry.

11. Samsung Engineering

Headquarters: South Korea Notable Projects: ADNOC Refinery Expansion, Aramco Jazan Refinery Overview: Samsung Engineering’s specialization in petrochemical projects and their strong presence in the Middle East continues to drive their success in the EPC market.

12. L&T Hydrocarbon Engineering

Headquarters: India Notable Projects: Dangote Refinery, Oman Oil Tank Terminal Overview: L&T’s expertise in hydrocarbon projects and their ability to deliver complex projects on time and within budget makes them a significant player in the global EPC market.

13. Worley

Headquarters: Australia Notable Projects: Shell Ethylene Oxide Project, Tengizchevroil Future Growth Project Overview: Worley’s focus on sustainability and innovation, particularly in energy transition projects, ensures their continued relevance and growth in the EPC sector.

14. Wood Group

Headquarters: UK Notable Projects: BP Clair Ridge Project, ExxonMobil Hebron Project Overview: Wood Group’s diverse portfolio and expertise in energy and industrial projects make them a reliable and innovative EPC contractor.

15. Chiyoda Corporation

Headquarters: Japan Notable Projects: Cameron LNG, Yamal LNG Overview: Chiyoda’s strength lies in its ability to execute large-scale LNG projects, particularly in challenging environments. Their focus on innovation drives their ongoing success.

16. SNC-Lavalin

Headquarters: Canada Notable Projects: Codelco Mining Projects, Riyadh Metro Project Overview: SNC-Lavalin’s expertise in infrastructure and energy projects, coupled with their commitment to sustainability, positions them as a leading EPC contractor.

17. Doosan Heavy Industries & Construction

Headquarters: South Korea Notable Projects: Ras Al-Khair Power and Desalination Plant, Shoaiba II Power Plant Overview: Doosan’s specialization in power and desalination projects, particularly in the Middle East, makes them a key player in the EPC industry.

18. Tecnicas Reunidas

Headquarters: Spain Notable Projects: Al Zour Refinery, Duqm Refinery Overview: Tecnicas Reunidas’ expertise in refinery and petrochemical projects, particularly in the Middle East, continues to drive their success in the EPC market.

19. China National Petroleum Corporation (CNPC)

Headquarters: China Notable Projects: Amur Gas Processing Plant, South Pars Phase 11 Overview: CNPC’s global reach and expertise in oil & gas projects make them a significant player in the EPC industry, particularly in Asia and the Middle East.

20. GS Engineering & Construction

Headquarters: South Korea Notable Projects: Karbala Refinery, RAPID Project Overview: GS E&C’s specialization in refinery projects and their strong presence in the Middle East ensure their continued relevance and growth in the EPC sector.

0 notes

Text

Automotive Lubricants Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

The Global Automotive Lubricants market is looking to be at the heart of the automotive industry since vehicles and automotive technologies continue gaining momentum. The market relates to the research, development, manufacturing, and marketing of lubricants that are needed for several types of applications in various systems within cars, including engines, gearboxes, and differential housing. Lubricants act as an anti-friction agent that helps in lessening corrosion, improving operating performance, and thereby enhance vehicle efficiency, hence increasing the chances of its smooth flow.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/3136

Companies

Exxon Mobil Corporation

Royal Dutch Shell

Chevron Corporation

BP plc

Total S.A.

PetroChina Company Limited

China Petroleum & Chemical Corporation (Sinopec)

Lukoil

Idemitsu Kosan Co., Ltd.

Fuchs Petrolub SE

Valvoline Inc.

Gazprom Neft

Repsol S.A.

Indian Oil Corporation Limited

SK Enmove Co., Ltd.

Morris Lubricants

Motul

Amsoil Inc.

Penrite Oil Company

ENEOS Corporation

T𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:@https://www.metastatinsight.com/report/automotive-lubricants-market

The Global Automotive Lubricants market is likely to expand with the advancements of automotive technologies, such as electric and hybrid vehicles, which are going to change the type of lubricant needed. Petroleum-based lubricants are still going to dominate a large portion of the market, but EVs will increase the demand for specialized lubricants. These lubricants will address diverse needs, including maintaining efficiency in battery cooling systems, electric motor lubrication, and ensuring that the reduced mechanical parts in EVs run smoothly.

The product range in the automotive lubricants sector is diversified, ranging from engine oils, transmission fluids, grease, and gear oils. Each category is meant to serve a different purpose in vehicle maintenance and performance, and their importance cannot be overstated. The largest share in the market is engine oils, which are formulated to maintain fluidity at high temperatures and pressures. Transmission fluids are another critical segment of the product, ensuring smooth gear shifting and the life of the transmission system. Gear oils and greases, the lubricants normally used on bearings and similar moving parts, ensure smoother running parts that prevent corrosion and help vehicles run as long and safely as desired.

The Global Automotive Lubricants market will move with the times as will the automotive industry. As the number of ICE vehicles is so massive, there will always be a market for conventional lubricants; however, penetration of electric vehicles and the need to improve technology will lead the market to the development of specialized lubricants. Increased performance and sustainability will focus the market on a whole range of automotive applications and ensure that vehicles of every type run efficiently.

Global Automotive Lubricants market is estimated to reach $100,188.59 Million by 2031; growing at a CAGR of 3.6% from 2024 to 2031.

Contact Us:

+1 214 613 5758

#AutomotiveLubricants#AutomotiveLubricantsmarket#AutomotiveLubricantsindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

Top 20 Oil Companies in the World: Market Leaders and Their Global Impact

The oil industry is one of the biggest drivers of the global economy. From fueling cars to powering industries, oil companies play a crucial role in our everyday lives. Some of the world’s largest oil companies generate billions in revenue, influencing energy markets, employment, and even government policies.

In this article, we’ll explore the top 20 oil companies in the world, their global impact, and how American oil companies shape the industry. Whether you’re an investor, business owner, or industry professional, this guide provides valuable insights into the biggest oil companies today.

Ranking the Top 20 Oil Companies

To determine the top 20 oil companies in the world, we looked at several key factors:

Revenue and market capitalization

Production capacity (barrels per day)

Global influence and operations

Investment in renewable energy

Technological advancements

Here’s a list of the leading oil companies that dominate the global market.

1. Saudi Aramco (Saudi Arabia)

The largest oil company in the world, Saudi Aramco produces over 10 million barrels of oil per day.

Generates over $400 billion in revenue annually.

Major supplier to Asia, Europe, and the U.S.

2. ExxonMobil (USA)

One of the biggest U.S. oil and gas companies, ExxonMobil operates in over 50 countries.

Invests heavily in carbon capture technology and alternative fuels.

3. Shell (UK/Netherlands)

A global leader in oil and natural gas production.

Expanding investments in renewable energy and electric vehicle charging.

4. BP (UK)

Major oil producer with a focus on reducing carbon emissions.

Investing in offshore wind farms and hydrogen fuel technology.

5. Chevron (USA)

One of the top U.S. oil companies, producing millions of barrels daily.

Expanding into geothermal and renewable energy solutions.

6. TotalEnergies (France)

Leading the way in biofuels and green energy projects.

Operates in over 130 countries.

7. PetroChina (China)

China’s biggest oil producer, focusing on natural gas and crude oil exports.

8. Sinopec (China)

Another Chinese oil giant, specializing in refining and petrochemicals.

9. Gazprom (Russia)

Largest gas producer in the world, supplying energy to Europe and Asia.

10. Rosneft (Russia)

One of Russia’s biggest state-owned oil companies.

11. ConocoPhillips (USA)

A major independent U.S. oil producer, known for shale oil production.

12. Eni (Italy)

Italy’s largest energy company, focusing on sustainable energy.

13. Equinor (Norway)

Norway’s leading oil company, investing in offshore wind farms.

14. Reliance Industries (India)

India’s largest private-sector oil producer.

15. Pemex (Mexico)

Mexico’s state-owned oil company, producing millions of barrels daily.

16. Kuwait Petroleum Corporation (Kuwait)

Major oil exporter in the Middle East.

17. Abu Dhabi National Oil Company (ADNOC) (UAE)

Leading Middle Eastern oil producer, investing in renewable energy.

18. QatarEnergy (Qatar)

One of the biggest natural gas suppliers in the world.

19. Marathon Petroleum (USA)

Largest U.S. refining company, producing gasoline and petrochemicals.

20. Occidental Petroleum (Oxy) (USA)

A key player in U.S. shale oil production, with carbon reduction projects.

How U.S. Oil Companies Shape the Global Market

The top 20 oil companies in the USA play a major role in energy production and exports. Companies like ExxonMobil, Chevron, and ConocoPhillips are leading the way in oil production and innovation. The rise of shale oil has transformed the U.S. into one of the largest oil producers in the world.

Oil Exports: The U.S. exports millions of barrels of crude oil daily, impacting global oil prices.

Technological Advancements: American oil companies invest in automation, artificial intelligence, and carbon capture.

Renewable Energy Transition: Major players are investing in solar, wind, and hydrogen to diversify energy sources.

Economic and Environmental Impact of Major Oil Companies

1. Economic Influence

The oil industry creates millions of jobs worldwide.

Billions of dollars are invested in infrastructure, research, and new technologies.

Countries with strong oil exports benefit from higher GDP growth.

2. Environmental Considerations

Carbon emissions remain a major concern.

Many companies are investing in carbon-neutral projects and green energy.

Electric vehicles and alternative fuels are reshaping the future of energy.

Future Trends in the Oil Industry

Shift to Renewable Energy: More oil companies are moving towards solar, wind, and biofuels.

Digital Transformation: AI and data analytics improve efficiency and reduce costs.

Geopolitical Factors: Global conflicts and trade policies will impact oil production and pricing.

Conclusion

The top 20 oil companies in the world are shaping the future of global energy. From traditional crude oil production to investments in renewable energy, these companies continue to evolve.

As a business leader or investor, staying informed about these industry giants can help you navigate market trends. At Exporters Worlds, we connect buyers with suppliers in the oil and energy sector, ensuring you get the best deals from trusted partners.

Stay ahead in the energy game with Exporters Worlds – your B2B marketplace for success.

Why Choose Exporters Worlds?

We connect global buyers and suppliers in the energy industry.

Our platform offers trusted partnerships and verified suppliers.

Stay updated with the latest market trends and business opportunities.

Explore Exporters Worlds today and grow your business in the oil and gas industry!

#Top 20 oil companies in the world#Top 20 oil companies in USA#Oil companies in the US#U.S. oil and gas companies#American oil companies

0 notes

Text

Asphalt Market Size, Share, and Industry Outlook

Asphalt Market Projected to Reach USD 389.9 Million by 2032, Driven by Infrastructure Development and Sustainable Innovations.

The Asphalt MarketSize was valued at USD 249.2 million in 2023. It is expected to grow to USD 389.9 million by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

The Asphalt Market is driven by increased global infrastructure development, road construction, and maintenance activities. Asphalt, commonly used in road paving, roofing, and waterproofing applications, plays a vital role in the transport and construction industries. The material’s cost-effectiveness, durability, and recyclability make it indispensable for both developed and emerging economies, particularly in projects involving highways, airports, and urban redevelopment.

Key Players

CEMEX S.A.B. de C.V.

Exxon Mobil Corporation

Royal Dutch Shell

Total SA

United Refining Company

Boral

Aggregate Industries Ltd.

China Petroleum & Chemical Corporation

Chevron Corporation

Marathon Petroleum Corporation

LafargeHolcim

Oldcastle Materials

Granite Construction Incorporated

Tarmac

CRH plc

Bitumina

Nynas AB

PBA (Petrochemical and Bitumen Association)

Colas Group

Reynolds Asphalt

Future Scope & Emerging Trends

The global asphalt market is expected to expand as governments ramp up investments in transportation infrastructure, especially in Asia-Pacific, Latin America, and the Middle East. A notable trend is the rising use of recycled asphalt pavement (RAP), which aligns with environmental regulations and sustainability goals. Polymer-modified asphalts are gaining popularity for enhancing performance under extreme weather conditions. Moreover, smart city initiatives, urbanization, and the need for high-performance road materials are driving innovation in asphalt formulations. The industry is also exploring bio-based alternatives and warm mix technologies to reduce emissions and energy consumption during production.

Key Points

Market projected to reach USD 389.9 million by 2032, growing at a steady CAGR.

Driven by road construction, roofing applications, and airport infrastructure.

Strong demand for recycled and sustainable asphalt solutions.

Government infrastructure investments globally are major growth accelerators.

Innovation in polymer-modified and warm mix asphalt enhances durability and eco-efficiency.

Emerging economies show rapid urbanization and industrial development, spurring market demand.

Conclusion

The Asphalt Market is set to grow significantly in the coming years, supported by infrastructure expansion and technological advancements in sustainable road materials. With an increasing focus on green construction and innovation, industry players have ample opportunities to align with future transportation and environmental goals.

Related Reports:

Ceramic Matrix Composites Market Size, Share & Segmentation By Product (Oxides, Silicon Carbide, Carbon, Others), By Application (Aerospace, Defense, Energy & Power, Electrical & Electronics, Others), By Region and Global Forecast for 2024-2032.

Biphenyl Market Size, Share & Segmentation By Product Type (Pure Biphenyl, Biphenyl Derivatives), By Application, By End-User Industry, By Regions and Global Forecast 2024-2032.

Agricultural Enzymes Market Size, Share & Segmentation By Product (Phosphatases, Dehydrogenases, Sulfatases, Other), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, Others), By Functionality (Fertility Products, Growth Enhancing Products, Control Products), By Region and Global Forecast for 2024-2032.

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Asphalt Market#Asphalt Market Size#Asphalt Market Share#Asphalt Market Report#Asphalt Market Forecast

0 notes

Text

Illustration detail from Shell Petroleum Corporation’s New Orleans and Vicinity Road Map - 1932.

#old new orleans#new orleans#shell oil#road maps#vintage road maps#highway maps#vintage highway maps#shell petroleum corporation#shell petroleum#gas stations#gas station road maps#vintage illustration#vintage advertising#maps#vintage maps#lake borgne#fishing#tarpon fishing

2 notes

·

View notes